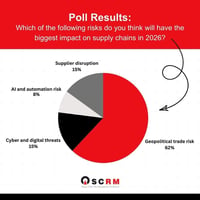

Last week, I asked the question “What do you see as the biggest supply chain risk heading into...

Prioritizing risk using structural simulation for complex global supply chains

By Greg Schlegel CPIM, CSP, Jonah, Jim de Vries, and J. Chris White, DBA for Supply Chain Management Review Magazine

Since the pandemic it has become readily apparent that our global supply chains are very complex, and in some cases, very brittle. The pandemic exposed these flaws and attracted the attention of C-suites and boards very quickly. Unfortunately, many organizations’ supply chains were too brittle and could not adapt to the largest imbalance of demand and supply in over 50 years. This is historically coined the bullwhip effect. Post-pandemic, more and more disruptions to global supply chains continue to plague companies. Consequently, the importance of some suppliers in the overall supply chain is beginning to emerge, one of which is the nexus supplier. This article looks at the role of nexus suppliers and offers simulation-based results of a hypothetical, yet realistic, set of scenarios to guide companies as they continue to operate their supply chains in the VUCA (volatility, uncertainty, complexity, ambiguity) world in which we now find ourselves.

There are many definitions and perspectives on nexus suppliers. One that is referenced often by academicians is “any supplier in a multi-tiered supply network that potentially exerts a profound impact due to its network position” (Yan et al., 2015, p. 53). Yan et al. go on to say that a “supplier a few tiers removed can be a critical supplier to a focal buying firm based on how it is connected in the extended supply network.” For nexus suppliers, the structural embeddedness (i.e., which firms the supplier is connected to and how these firms operate in broader networks) has a major impact on the supply chain (Choi & Kim, 2008). Furthermore, Namdar et al. (2024) discuss the impact of disruptions in supply chains, specifically how disruptions cascade or ripple through supply chains. Combine the two concepts of cascading disruptions and nexus suppliers and we have a formula for potentially disastrous impacts on supply chains. Along those lines, Namdar et al. (2024) were able to show the devastating operational impact of disruptions at nexus suppliers.

Structural modeling approach

Due to the structural nature of the concept of nexus suppliers, we use a structural modeling approach in our simulation scenarios. A structural modeling approach differs from the traditional statistical and network modeling approaches as it relates to supply chains in several ways. Structural modeling has the following three major benefits.

- The structural modeling approach focuses on the activities and operations that occur in the supply chain. Data is used to calibrate and enhance the structural model, but data are not necessary to build the structural model. Structural models are activity oriented. Conversely, the statistical modeling approach focuses on data related to the supply chain and treats the activities and operations of the supply chain as a black box that we cannot look into. For statistical models, data is foundational because the statistical model is a data-oriented model. No data, no model. Network models, such as the one used by Namdar et al. (2024), focus on connections of nodes, where the nodes and the connections may have properties associated with them. Like statistical models, network models do not focus on activities and operations like structural models. As with statistical models, data related to nodes and connections may not be available. Because data is not required to build the structural model, structural modeling can provide scenario analysis capabilities when data is not readily available or easy to obtain.

- The structural modeling approach is more realistic when projecting or forecasting far into the future (i.e., months, years). Structural models include feedback mechanisms that control how entities in the supply chain act, react, and respond to various things happening in the supply chain. Consequently, as conditions change throughout the supply chain (e.g., orders drastically change, deliveries are disrupted), the feedback mechanisms in a structural model can show how the supply chain as a system is capable of adapting or recovering. On the other hand, statistical models and network models are direct calculations of future results. Thus, these types of models have no ability to incorporate the feedback associated with adaptations and responses from various entities in the supply chain as conditions change over time. In essence, statistical models and network models are static, not dynamic. With the ability to model dynamic, changing conditions and the responses of companies in the supply chain to those changing conditions, structural modeling is a powerful method for conducting long-range, strategic what-if scenarios.

- Structural models can accommodate new situations and conditions that have never occurred previously. Because structural models include activities and operations, structural models can show how entities in a supply chain act or react to different conditions in the supply chain. Typically, these are set as policies for the entities in the supply chain. Similar to Agentic AI, these policies guide the decisions and actions of the entities in the structural model. Statistical models cannot accommodate new situations or conditions. Because statistical models rely completely on data, if there is no data for the situation (i.e., because it is new and has not been experienced previously) then there is no data to build the statistical model. Statistical models are excellent predictors in stable or consistent conditions, but their reliance on data makes them ill-suited for looking at major changes in supply chains such as disruptions or shipping delays. Network models can look at different configurations of the network nodes and connections, but this is a static view with no ability to show how the network may change and adapt to move from one configuration to another. In many cases today in our VUCA environment, structural modeling proves to be more effective because it can accommodate these disruptions or other major changes in the supply chain that have never been seen or experienced before.

Simulation scenarios

Figure 1 provides the backdrop for a hypothetical supply chain that may experience disruptions with key nexus suppliers. In Figure 1, the primary OEM (original equipment manufacturer) resides in the U.S., represented by the black box in the upper left of the figure. This OEM has a Tier 1 supplier in the U.S. that has three Tier 2 suppliers scattered in China, Africa, and Mexico. These Tier 2 suppliers each provide a different component that goes into the subsystem at the Tier 1 company. Thus, a component from each Tier 2 supplier is required. These are not three Tier 2 suppliers all providing the same part that would allow shifting orders among the suppliers to mitigate issues. The white numbers seen on the black arrows are the average transportation times in weeks. The Tier 1 can deliver to the OEM in one week. The Tier 2 in Mexico delivers to the Tier 1 in four weeks. The Tier 2 in Africa delivers to the Tier 1 in eight weeks. The Tier 2 in China delivers to the Tier 1 in 12 weeks. Essentially, transportation and shipping times are proportional to the distance from the Tier 2 supplier to the Tier 1 company. A baseline plus four scenarios was analyzed with the structural modeling approach using a system dynamics-based simulation model. The objective is to show how an OEM is impacted differently by disruptions in the supply chain depending on where the disruptions occur. The five scenarios are the following:

- Baseline: Normal operations for all companies. Steady demand at 100 orders/week.

- Scenario 1: Same as the baseline, but the U.S.- based Tier 1 supplier shuts down for two months (i.e., experiences a two-month disruption) beginning in Week 25. All other companies operate normally.

- Scenario 2: Same as the baseline, but the Mexico-based Tier 2 supplier shuts down for two months beginning in Week 25. All other companies operate normally.

- Scenario 3: Same as the baseline, but the Africa-based Tier 2 supplier shuts down for two months beginning in Week 25. All other companies operate normally.

- Scenario 4: Same as the baseline, but the China-based Tier 2 supplier shuts down for two months beginning in Week 25. All other companies operate normally.

One of the benefits of structural modeling is the ability to conduct experiments much like the scientific method. One variable or condition can be changed while all other variables and conditions remain the same. This isolates any impacts to determine easily which variable or condition is responsible for the impact. For these scenarios, all variables will remain the same except for the two-month disruption that occurs at the exact same time in the simulation (Week 25), but at a different supplier in each of the scenarios.

To maintain similarity, each company in the supply chain model is the exact same agent model. This agent model has a flow from receiving into a raw material inventory which goes into production to create a finished goods inventory to be used for deliveries to the next entity in the supply chain (or the final customer if this is the OEM). In all scenarios, each company has an inventory policy of holding four weeks of raw material inventory and four weeks of finished goods inventory. At the beginning of the simulation, when the demand is 100 orders/week, this results in 400 units in raw material inventory and 400 units in finished goods inventory, with 100 units/week flowing through receiving, production, and deliveries.

Figure 2 shows the results for the OEM from the five scenarios in a table. The simulation run is two years with a weekly time step, which results in 104 weekly time steps for the simulation. In Figure 2, the baseline scenario with constant demand of 100 orders/week has no high/low spikes in raw material inventory or finished goods inventory, and lead time remains constant at one week with 100% on-time deliveries. Financially, the lowest profit margin ever experienced is 20%, and the total cash available at the end of the 104-week simulation is $120,800 (from a beginning balance of $100,000). All other scenarios results will be compared against this baseline.

Figure 3 through Figure 5 show the results over all the time steps (weeks) of the simulations for the OEM for its raw material inventory, finished goods inventory, and deliveries for all five scenarios. The order of the scenarios is such that the disruption occurs further away with each successive scenario. Yan et al. (2015) showed that disruptions have less of an impact on the operations of an OEM when these disruptions are deeper in the tiers of a supply chain. That is, a disruption at Tier 1 has a worse impact on the OEM than a disruption at Tier 2, and a disruption at Tier 2 has a worse impact on the OEM than a disruption at Tier 3, and so on. The results shown in Figures 3 through 5 replicate those tier-based results. A disruption at the U.S. Tier 1 supplier has a worse impact on the OEM than disruptions at the three Tier 2 suppliers. Furthermore, the simulations in these scenarios also show that the geographical distance can change the impact of a disruption. In this case, a disruption at the Mexico Tier 2 supplier has more of an impact on the OEM than a disruption at the Africa Tier 2 supplier, and a disruption at the Africa Tier 2 supplier has more of an impact on the OEM than a disruption at the China Tier 2 supplier. In essence, the “distance” of the disruption from the OEM in terms of both depth of tiers and geographical distance impacts how badly the operations at the OEM are affected. The closer the disruption (either in terms of depths of tiers or geographical distance), the worse the impact.

For example, consider the impacts on the raw material inventory of the OEM in Figure 3. For the baseline (solid black line), the raw material inventory holds steady at 400 units (i.e., four weeks of inventory based on 100 orders/week). For Scenario 1 with the two-month disruption at Week 25 at the U.S. Tier 1 supplier (red dashed line), notice that the raw material inventory drops about eight weeks after the disruption occurs because there are four weeks of finished goods inventory that still get delivered from the Tier 1 to the OEM and the OEM also has four weeks of raw material inventory. After the disruption, the bullwhip impact to the OEM causes a high spike of +165% for its raw material inventory (above the baseline value of 400 units), as also indicated in the table in Figure 2.

Without getting into all the details, Figures 3 through 5 show much more volatility to the operations of the OEM when the disruption occurs at the U.S. Tier 1 supplier than when it occurs at the other three Tier 2 suppliers. Furthermore, among the Tier 2 suppliers, the volatility and operational impact to the OEM is worse when the disruption occurs at the Mexico Tier 2 supplier and least when the disruption occurs at the China Tier 2 supplier. For the Tier 2 suppliers, there is inventory tied up in the transportation routes. Essentially, the inventory that is in transit serves as buffer inventory that “buys time” for the OEM. The longer the transportation route, the more inventory is tied up and acts as a buffer. For instance, the four-week average transit from the Mexico Tier 2 supplier to the U.S. Tier 1 supplier represents four weeks of additional deliveries to the Tier 1. For the Africa Tier 2 supplier, the eight-week transit time represents eight weeks of additional inventory. And, for the China Tier 2 supplier, the 12-week transit time represents an additional12 weeks of inventory in the pipeline.

Turning theory into practice: benefits of structural modeling

The results of this simulation effort provide several insights and opportunities for companies.

First, as discussed in the opening section, Namdar et al. (2024) were able to show the devastating operational impact of disruptions at nexus suppliers. The network model used by that team to study the operational impact of disruptions at various suppliers took several months to develop. The structural model used on the project presented here only took several days. In the span of a single week, we replicated the results of the Namdar study. This has serious business and financial implications for companies. The ability to understand the impact of supply chain disruptions quickly means decisions can be made quicker and the impacts of disruptions can be mitigated (or removed) quickly.

Second, our analysis expanded the theory of the impact of disruptions and nexus suppliers. Yan et al. (2015) showed that disruptions have less of an impact on the operations of an OEM when these disruptions are deeper in the tiers of a supply chain. In addition to this behavior, we also showed that disruptions have less of an impact on the operations of an OEM when these disruptions occur at a larger geographical distance from the OEM because in-transit goods essentially represent additional buffer inventory. Consequently, both tier-level and geographical distance can be mitigators of the impacts of disruptions. This geographical distance impact leads to counterintuitive responses to disruptions. It is typically thought that disruptions tend to expand or grow as they propagate from supplier to supplier or over long distances that have transportation delays. Instead, we have demonstrated that the opposite is true. With the focus on redesigning supply chains by nearshoring or reshoring from other countries, especially China, this action may unintentionally intensify operational issues associated with disruptions. There may be other reasons or benefits for nearshoring or reshoring from other countries, but operational impacts may not be one of them. If we add the fact that changing suppliers and setting up new suppliers can take 9-18 months at an approximate cost of $1M-$2M, we may find that there are situations where it is more beneficial to continue to use suppliers in the foreign countries rather than nearshoring or reshoring them.

Third, the results of Namdar et al. (2024) and these simulations show that all disruptions are not created equal. The same disruption (i.e., same magnitude, same duration) can have a different operational impact on the end company (e.g., OEM) depending on where it occurs in the tiers of the supply chain. Thus, when risk reports show potential disruptions at numerous suppliers in a company’s supply chain, the company may be able to prioritize those risks based on the “distance” from the OEM, both in terms of depth of tiers and geographical distance. The closer disruptions get attention first, followed by the disruptions that are further away. The structural modeling approach used for the scenarios in this article is paramount to understanding these operational impacts over time from disruptions. As can be seen in the oscillations in the figures presented here, structural models can show how well a supply chain system can respond and recover (i.e., how chaotic the oscillations are) as well as how long it takes for the supply chain system to settle down to its new stable state. In the real world, there are many times when supply chain managers make knee-jerk reactions to the oscillations they see in orders, inventories, production, etc. Often, these oscillations will naturally settle after some period of time. We can unintentionally exacerbate these oscillations if we are unaware of their calming cycle.

Fourth, the approach used on this project shows how digital twin models can benefit organizations. Using a digital twin model, we can run “scientific experiments” where all variables remain constant except for one variable. Any changes seen in the simulation results can be directly associated with that one variable. This is extremely beneficial because companies can use digital twin models to run hundreds or even thousands of simulations over a very short time period (e.g., days) and learn how every variable in the model has its singular impact on other variables. With that information, variables can be prioritized concerning their ability to mitigate or remove the negative operational impacts of disruptions or other major changes in a supply chain system.

Recommendations for joint future research

Review the impact study by Namdar et al. (2024) of modularity within a supply chain on how disruptions mitigate through the supply chain. Their results are extremely insightful and provide guidance on how to prioritize disruptions. However, their team used a network model, which is static in nature and cannot handle dynamic, adaptive changes that result in a real- world system like a supply chain as companies react and respond to conditions. To extend their research on modularity, we propose conducting similar what-if scenarios using a structural modeling approach like the one presented in this article.

Conclusions

Disruptions in your supply chain can hurt your business, but not all disruptions are the same. Our study shows that where a disruption happens really matters. If the problem is close to you, like at a supplier in your own country or in the first tier, the damage is much worse than if it’s farther away or deeper in the supply chain.

Surprisingly, longer shipping distances can help because the goods already on the way act like a buffer and give your business more time to adjust.

We used structural modeling, which is a type of digital twin, to run smart simulations that act like scientific experiments. The structural modeling approach is faster and more flexible than traditional statistical and network models. With structural modeling, you can test different scenarios, see how your supply chain reacts, and make better decisions quickly, instead of waiting months.

This approach also shows that quick reactions to disruption data aren’t always helpful. Sometimes supply chains settle down on their own. Acting too fast and interfering with that “calming process” can actually make things worse.

In short:

- disruptions closer to home hit harder.

- longer-distance suppliers might give more stability.

- digital twins let you test and prepare before disruptions happen; and

- not every disruption deserves the same level of response.

If you’re thinking about reshoring or switching suppliers, you should run these types of structural simulations first. The costs and risks might not be what you expect

References

- Choi, T. Y., & Kim, Y. (2008). Structural embeddedness and supplier management: A network perspective. Journal of Supply Chain Management, 44(4), 5-13.

- Namdar, J., Blackhurst, J., Zhao, K., and Song, S. (2024). Cascading disruptions: Impact of modularity and nexus supplier predictions.

- Journal of Supply Chain Management, 60(3), 18-38. Yan, T., Choi, T. Y., Kim, Y., and Yang, Y. (2015). A theory of the nexus supplier: A critical supplier from a network perspective. Journal of Supply Chain Management, 51(1), 52-66

Greg Schlegel CPIM, CSP, Jonah, is the founder/CEO of The Supply Chain Risk Management Consortium, consisting of 33 companies and 1,750 supply chain risk pros who identify, assess, mitigate and manage supply chain risks. He has been a supply chain executive for several Fortune 100s and a consultant for IBM. He has taught supply chain and risk management for 10 years at Lehigh University and has been an adjunct professor teaching enterprise risk management for Villanova University. Schlegel and Dr. Robert J. Trent, of Lehigh University, have co-authored a first-of-a-kind book, “Supply Chain Risk Management: An Emerging Discipline.” In the last 15 years, he has facilitated over 120 supply chain and risk management workshops around the globe.

Jim de Vries is the founder and managing partner of Enhance International Group (EIG), a global management and marketing consulting firm focused on delivering practical and transformational solutions to help organizations work smarter and faster. He is a senior-level executive with over 35 years of experience in Lean Six Sigma, supply chain risk and resiliency, operational excellence, program management, digital transformation, and strategic planning across a wide range of industries including energy, manufacturing, logistics, and consumer goods. De Vries holds a BS in mechanical engineering with a minor in physics from the University of Dayton.

J. Chris White, DBA is the co-founder & CEO of scmBLOX, a software development and consulting company aimed at improving planning and operations for organizations, especially in the domain of supply chain management. He is a senior-level executive with over 30 years of experience in Lean, Six Sigma, supply chain management, program management, modeling/simulation, organizational design, leadership development, and strategic planning within both government and commercial organizations.